TAX INCENTIVES

(FEDERAL) RESIDENTIAL ENERGY TAX CREDITS

According to the Internal Revenue Service, “The residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Qualifying properties are solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and, starting December 31, 2020, qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date. Only fuel cell property is subject to a limitation, which is $500 with respect to each half kilowatt of capacity of the qualified fuel cell property. Generally, this credit for alternative energy equipment terminates for property placed in service after December 31, 2023.”

(FEDERAL) ENERGY TAX CREDITS FOR BUSINESSES

A variety of federal tax credits are available for businesses, ranging from investment tax credits for renewable energy projects to credits for alcohol and cellulosic biofuels to renewable electricity production.

(state) RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT (RETITC)

The Renewable Energy Technologies Income Tax Credit (RETITC) is a Hawaiʻi State tax credit that allows individuals or corporations to claim an income tax credit for up to 35 percent of the total cost for a solar PV, solar space heating, or solar thermal water heating system, subject to cap amounts, and up to 20 percent of the cost for wind-powered energy systems. If the credit earned exceeds the total amount of taxes owed by a tax payer in a single tax year, the credit may be carried forward. Under certain conditions the credit may be refundable. Please note: The maximum incentive cap varies by technology and property type.

(STATE) RENEWABLE FUELS PRODUCTION TAX CREDIT

Per HRS 235-110.32, the Renewable Fuels Production Tax Credit was reinstated in 2022 with new Greenhouse Gas and eligibility requirements.

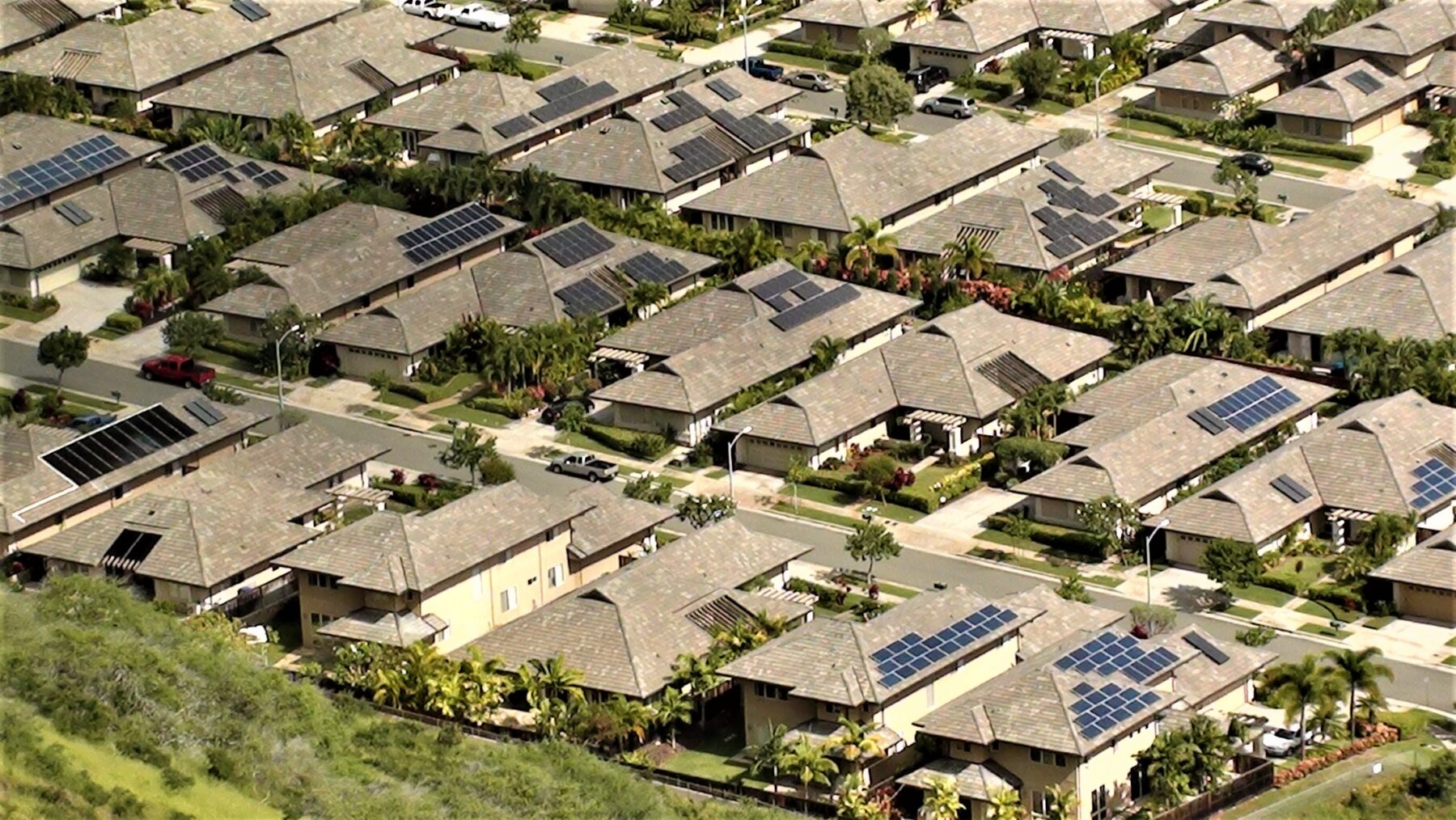

(CITY AND COUNTY OF HONOLULU) Real PROPERTY EXEMPTION FOR ALTERNATIVE ENERGY IMPROVEMENTS

In 2009, the City and County of Honolulu created a real property tax exemption for alternative energy improvements. Alternative energy improvements include solar, wind, hydropower, tidal, wave, solid waste and increased efficiency in fossil fuel burning facilities.